disputeresponse Jul/ 3/ 2025 | 0

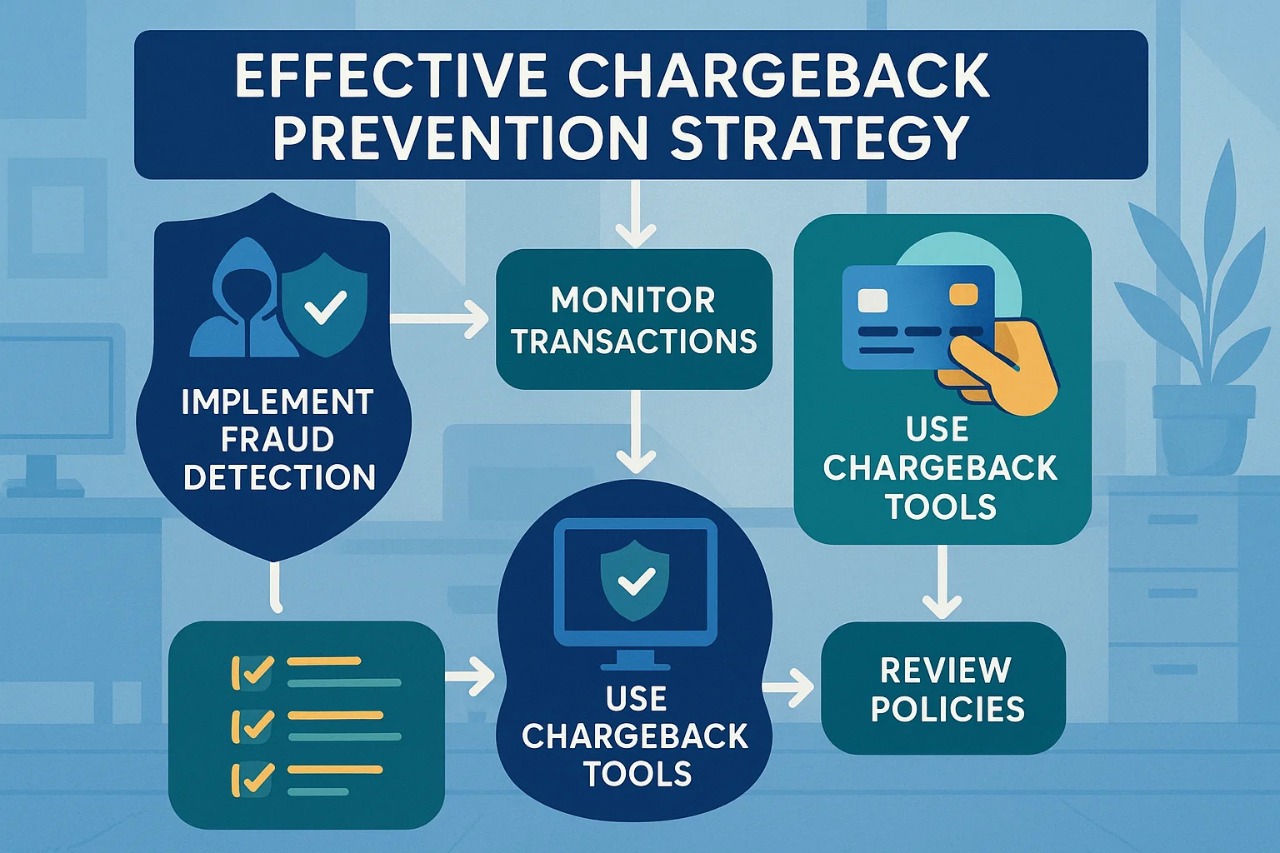

Chargebacks can have a significant impact on your bottom line, and preventing them should be a top priority for any merchant. A well-crafted chargeback prevention strategy not only minimizes losses but also protects your reputation with payment processors and customers. This guide walks you through the steps to build an effective chargeback prevention strategy tailored to your business needs.

1. Understand Chargeback Risk Factors

To effectively combat chargebacks, it’s crucial to identify the risk factors that lead to them. Common chargeback causes include fraud, customer disputes, and processing errors. Start by analyzing your business’s historical chargeback data to identify patterns and pinpoint potential areas of vulnerability. This data will help you customize your prevention strategies based on your unique business environment.

2. Implement a Clear and Transparent Refund Policy

A well-communicated refund policy is key to preventing chargebacks. Ensure that your refund policy is clear, easy to understand, and easily accessible to customers. Provide full transparency on the process and conditions under which refunds are granted. The easier it is for customers to request a refund, the less likely they are to initiate a chargeback.

3. Strengthen Fraud Prevention Measures

Fraudulent chargebacks can be avoided by implementing robust fraud detection tools. Use tools like Address Verification Systems (AVS), Card Verification Value (CVV) checks, and 3D Secure authentication to minimize fraudulent transactions. Additionally, consider using machine learning models that can flag suspicious transactions in real-time to reduce fraud risk.

4. Enhance Customer Service and Communication

Sometimes, chargebacks stem from a lack of communication between customers and merchants. Providing excellent customer service can go a long way in preventing chargebacks. Offer multiple ways for customers to reach your support team and resolve any issues before they escalate to a chargeback. A quick resolution of disputes can often prevent a formal chargeback request.

5. Maintain Detailed Transaction Records

Having complete records of each transaction is critical when it comes to chargeback disputes. This includes customer details, order history, shipping information, and communication logs. Keeping these records organized and easily accessible will help you respond quickly and effectively to any chargeback claims.

6. Utilize Chargeback Prevention Tools

There are numerous chargeback prevention tools available that can help you manage risk and disputes. These include chargeback alerts, automated monitoring systems, and tools that help with dispute resolution. Integrating these tools with your payment gateway can provide an additional layer of protection and help you stay ahead of potential chargeback issues.

7. Monitor Chargeback Trends and Adapt

Chargeback prevention is an ongoing process that requires continuous monitoring. Regularly review your chargeback data to identify emerging trends or new risks. Adjust your prevention strategies based on this data to stay proactive in combating chargebacks and improving your overall payment security.

Conclusion

Building an effective chargeback prevention strategy involves a comprehensive approach that addresses customer service, fraud prevention, and clear communication. By implementing these steps and utilizing the right tools, merchants can minimize chargeback risks and protect their revenue. Stay proactive and adapt your strategies as needed to keep your business secure from chargebacks.